Predict GARCH(1,1) time series.

Usage

# S3 method for garch1c1

predict(object, n.ahead = 1, Nsim = 1000, eps, sigmasq, seed = NULL, ...)Arguments

- object

an object from class

"garch1c1".- n.ahead

maximum horizon (lead time) for prediction.

- Nsim

number of Monte Carlo simulations for simulation based quantities.

- eps

the time series to predict, only the last value is used.

- sigmasq

the (squared) volatilities, only the last value is used.

- seed

an integer, seed for the random number generator.

- ...

currently not used.

Value

an object from S3 class "predict_garch1c1" containing

the following components:

- eps

point predictions (conditional expectations) of the time series (equal to zero for pure GARCH).

- h

point predictions (conditional expectations)of the squared volatilities.

- model

the model.

- call

the call.

- pi_plugin

Prediction intervals for the time series, based on plug-in distributions, see Details.

- pi_sim

Simulation based prediction intervals for the time series, see Details.

- dist_sim

simulation samples from the predictive distributions of the time series and the volatilties.

Details

Plug-in prediction intervals and predictive distributions are obtained by inserting the predicted volatility in the conditional densities. For predictions more than one lag ahead these are not the real predictive distributions but the prediction intervals are usually adequate.

For simulation prediction intervals we generate a (large) number of

continuations of the given time series. Prediction intervals can be based on

sample quantiles. The generated samples are stored in the returned object and

can be used for further exploration of the predictive

distributions. dist_sim$eps contains the simulated future values of

the time series and dist_sim$h the corresponding (squared)

volatilities. Both are matrices whose i-th rows contain the predicted

quantities for horizon i.

The random seed at the start of the simulations is saved in the returned

object. A speficific seed can be requested with argument seed. In

that case the simulations are done with the specified seed and the old state

of the random number generator is restored before the function returns.

This setup is similar to sim_garch1c1.

Examples

op <- options(digits = 4)

## set up a model and simulate a time series

mo <- GarchModel(omega = 0.4, alpha = 0.3, beta = 0.5)

a1 <- sim_garch1c1(mo, n = 1000, n.start = 100, seed = 20220305)

## predictions for T+1,...,T+5 (T = time of last value)

## Nsim is small to reduce the load on CRAN, usually Nsim is larger.

a.pred <- predict(mo, n.ahead = 5, Nsim = 1000, eps = a1$eps,

sigmasq = a1$h, seed = 1234)

## preditions for the time series

a.pred$eps

#> [1] 0 0 0 0 0

## PI's for eps - plug-in and simulated

a.pred$pi_plugin

#> lwr upr

#> [1,] -2.484 2.484

#> [2,] -2.544 2.544

#> [3,] -2.591 2.591

#> [4,] -2.628 2.628

#> [5,] -2.658 2.658

a.pred$pi_sim

#> 2.5% 97.5%

#> [1,] -2.447 2.465

#> [2,] -2.662 2.559

#> [3,] -2.426 2.624

#> [4,] -2.538 2.370

#> [5,] -2.645 2.637

## a DIY calculation of PI's using the simulated sample paths

t(apply(a.pred$dist_sim$eps, 1, function(x) quantile(x, c(0.025, 0.975))))

#> 2.5% 97.5%

#> [1,] -2.447 2.465

#> [2,] -2.662 2.559

#> [3,] -2.426 2.624

#> [4,] -2.538 2.370

#> [5,] -2.645 2.637

## further investigate the predictive distributions

t(apply(a.pred$dist_sim$eps, 1, function(x) summary(x)))

#> Min. 1st Qu. Median Mean 3rd Qu. Max.

#> [1,] -3.922 -0.8366 -0.064571 -0.004804 0.8683 4.050

#> [2,] -6.755 -0.8333 0.055137 0.012828 0.8895 4.320

#> [3,] -5.198 -0.8541 -0.015145 -0.004674 0.8138 4.290

#> [4,] -3.786 -0.8596 -0.001705 -0.029519 0.7609 4.241

#> [5,] -5.000 -0.8314 -0.019039 -0.016285 0.7956 4.860

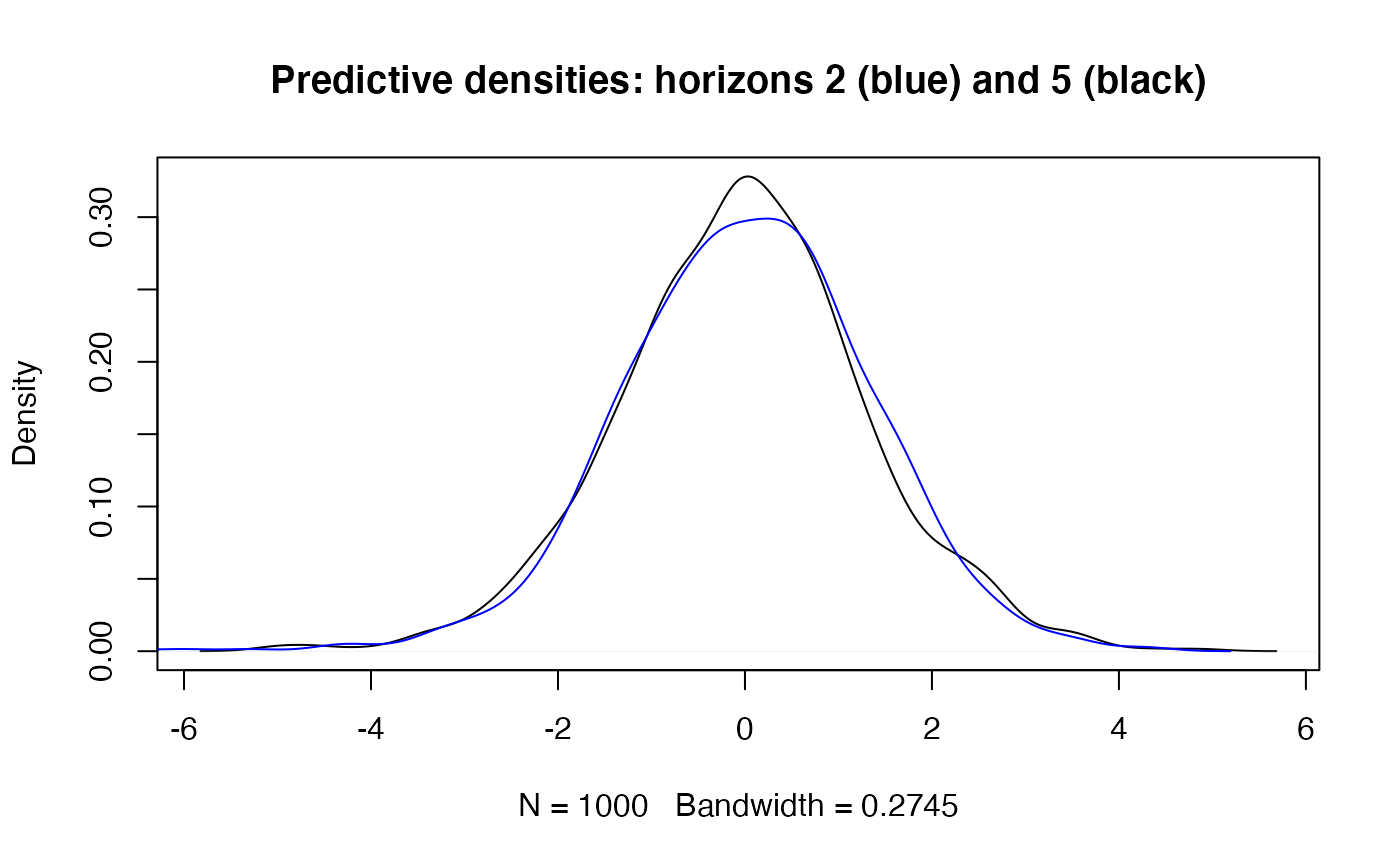

## compare predictive densities for horizons 2 and 5:

h2 <- a.pred$dist_sim$eps[2, ]

h5 <- a.pred$dist_sim$eps[5, ]

main <- "Predictive densities: horizons 2 (blue) and 5 (black)"

plot(density(h5), main = main)

lines(density(h2), col = "blue")

## predictions of sigma_t^2

a.pred$h

#> [1] 1.606 1.685 1.748 1.798 1.839

## plug-in predictions of sigma_t

sqrt(a.pred$h)

#> [1] 1.267 1.298 1.322 1.341 1.356

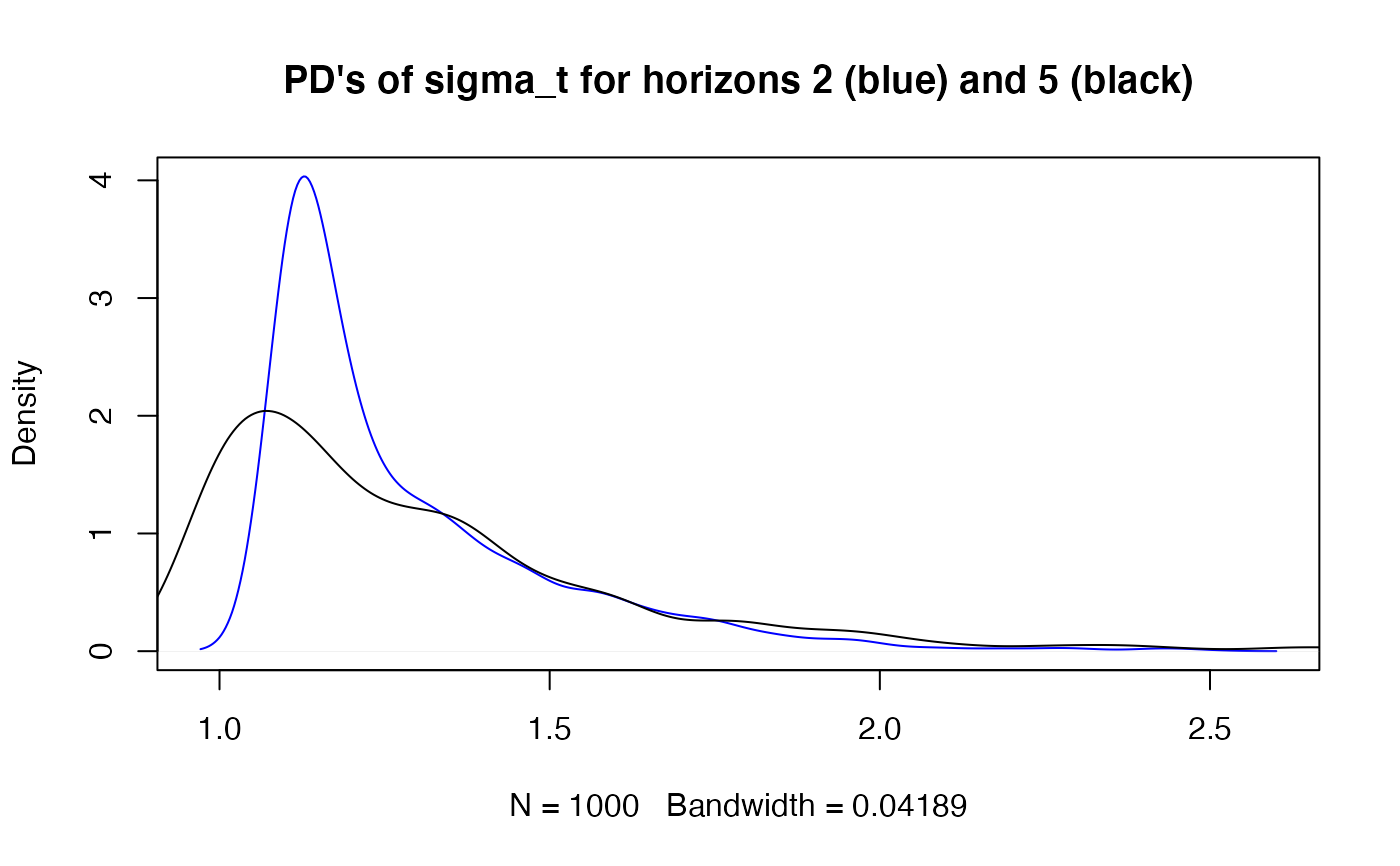

## simulation predictive densities (PD's) of sigma_t for horizons 2 and 5:

h2 <- sqrt(a.pred$dist_sim$h[2, ])

h5 <- sqrt(a.pred$dist_sim$h[5, ])

main <- "PD's of sigma_t for horizons 2 (blue) and 5 (black)"

plot(density(h2), col = "blue", main = main)

lines(density(h5))

## predictions of sigma_t^2

a.pred$h

#> [1] 1.606 1.685 1.748 1.798 1.839

## plug-in predictions of sigma_t

sqrt(a.pred$h)

#> [1] 1.267 1.298 1.322 1.341 1.356

## simulation predictive densities (PD's) of sigma_t for horizons 2 and 5:

h2 <- sqrt(a.pred$dist_sim$h[2, ])

h5 <- sqrt(a.pred$dist_sim$h[5, ])

main <- "PD's of sigma_t for horizons 2 (blue) and 5 (black)"

plot(density(h2), col = "blue", main = main)

lines(density(h5))

## VaR and ES for different horizons

cbind(h = 1:5,

VaR = apply(a.pred$dist_sim$eps, 1, function(x) VaR(x, c(0.05))),

ES = apply(a.pred$dist_sim$eps, 1, function(x) ES(x, c(0.05))) )

#> h VaR ES

#> [1,] 1 2.077 2.593

#> [2,] 2 2.075 2.972

#> [3,] 3 2.106 2.651

#> [4,] 4 2.066 2.680

#> [5,] 5 2.167 2.886

## fit a GARCH(1,1) model to exchange rate data and predict

gmo1 <- fGarch::garchFit(formula = ~garch(1, 1), data = fGarch::dem2gbp,

include.mean = FALSE, cond.dist = "norm", trace = FALSE)

mocoef <- gmo1@fit$par

mofitted <- GarchModel(omega = mocoef["omega"], alpha = mocoef["alpha1"],

beta = mocoef["beta1"])

gmo1.pred <- predict(mofitted, n.ahead = 5, Nsim = 1000, eps = gmo1@data,

sigmasq = gmo1@h.t, seed = 1234)

gmo1.pred$pi_plugin

#> lwr upr

#> [1,] -0.7521 0.7521

#> [2,] -0.7643 0.7643

#> [3,] -0.7758 0.7758

#> [4,] -0.7867 0.7867

#> [5,] -0.7970 0.7970

gmo1.pred$pi_sim

#> 2.5% 97.5%

#> [1,] -0.7408 0.7466

#> [2,] -0.7688 0.7601

#> [3,] -0.7631 0.7760

#> [4,] -0.7539 0.7210

#> [5,] -0.7779 0.8050

op <- options(op) # restore options(digits)

## VaR and ES for different horizons

cbind(h = 1:5,

VaR = apply(a.pred$dist_sim$eps, 1, function(x) VaR(x, c(0.05))),

ES = apply(a.pred$dist_sim$eps, 1, function(x) ES(x, c(0.05))) )

#> h VaR ES

#> [1,] 1 2.077 2.593

#> [2,] 2 2.075 2.972

#> [3,] 3 2.106 2.651

#> [4,] 4 2.066 2.680

#> [5,] 5 2.167 2.886

## fit a GARCH(1,1) model to exchange rate data and predict

gmo1 <- fGarch::garchFit(formula = ~garch(1, 1), data = fGarch::dem2gbp,

include.mean = FALSE, cond.dist = "norm", trace = FALSE)

mocoef <- gmo1@fit$par

mofitted <- GarchModel(omega = mocoef["omega"], alpha = mocoef["alpha1"],

beta = mocoef["beta1"])

gmo1.pred <- predict(mofitted, n.ahead = 5, Nsim = 1000, eps = gmo1@data,

sigmasq = gmo1@h.t, seed = 1234)

gmo1.pred$pi_plugin

#> lwr upr

#> [1,] -0.7521 0.7521

#> [2,] -0.7643 0.7643

#> [3,] -0.7758 0.7758

#> [4,] -0.7867 0.7867

#> [5,] -0.7970 0.7970

gmo1.pred$pi_sim

#> 2.5% 97.5%

#> [1,] -0.7408 0.7466

#> [2,] -0.7688 0.7601

#> [3,] -0.7631 0.7760

#> [4,] -0.7539 0.7210

#> [5,] -0.7779 0.8050

op <- options(op) # restore options(digits)