fBasics data sets

data-examples.RdThe following data sets are part of this package:

Capitalization | Market capitalization of domestic companies, |

cars2 | Data for various car models, |

DowJones30 | Down Jones 30 stocks, |

HedgeFund | Hennessee Hedge Fund Indices, |

msft.dat | Daily Microsoft OHLC prices and volume, |

nyse | NYSE composite Index, |

PensionFund | Swiss Pension Fund LPP-2005, |

swissEconomy | Swiss Economic Data, |

SWXLP | Swiss Pension Fund LPP-2000, |

usdthb | Tick data of USD to THB. |

Details

All datasets are data frames. A brief description is given below.

Capitalization:Capitalization

contains market capitalization of 13 domestic companies for 6 years

(from 2003 to 2008) in USD millions. Each row contains the data for

one company/stock exchange.

cars2:cars2

contains columns rowNames (model), Price,

Country, Reliability, Mileage, (Type),

(Weight), Disp. (engine displacement) and HP

(net horsepower) reprsenting the indicated properties of 60 car

models.

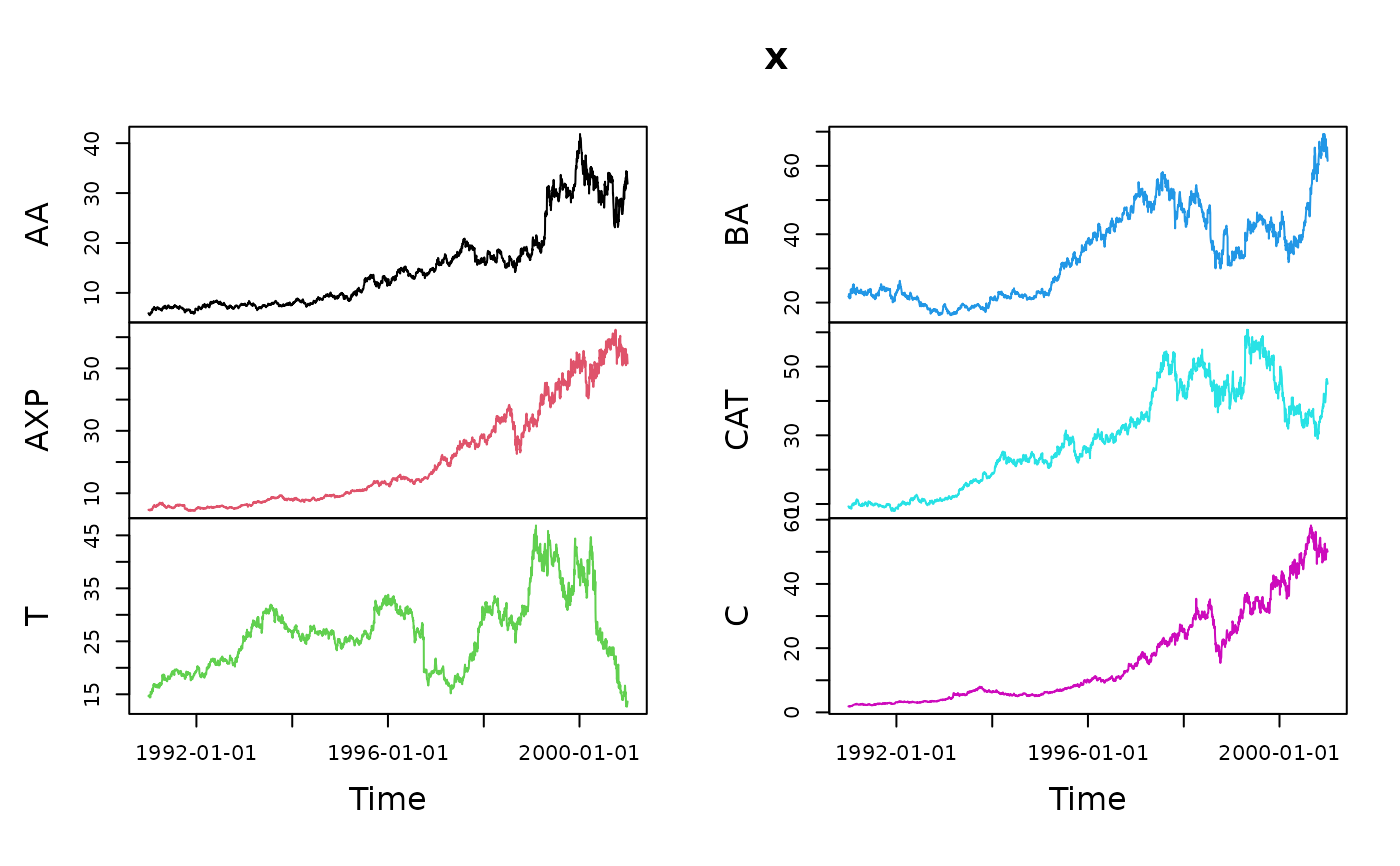

DowJones30:DowJones30

contains 2529 daily observations from the ‘Dow Jones 30’ Index

series. The first row contains the dates (from 1990-12-31 to

2001-01-02). Each of the remaining thirty columns represents the

closing price of a stock in the Index.

HedgeFund:HedgeFund

contains monthly percentage returns of 16 hedge fund strategies from

Hennessee Group LLC for year 2005.

msft.dat:msft.dat

contains daily prices (open, high, low and close) and volumes for the

Microsoft stocks. It is a data frame with column names

"%Y-%m-%d", "Open", "High", "Low",

"Close", "Volume".

Note: there is a dataset, MSFT, in package

timeSeries which contains the same data but is of class

"timeSeries".

nyse:nyse

contains daily records of the NYSE Composite Index from 1966-01-04 to

2002-12-31 (9311 observations). The data is in column "NYSE"

(second column). The first column contains the dates.

PensionFund:PensionFund

is a daily data set of the Swiss pension fund benchmark LPP-2005.

The data set ranges from 2005-11-01 to 2007-04-11.

The columns are named: SBI, SPI, SII, LMI, MPI, ALT, LPP25, LPP40, LPP60.

swissEconomy:swissEconomy

contains the GDP per capita (GDPR), exports (EXPO),

imports (IMPO), interest rates (INTR), inflation

(INFL), unemployment (UNEM) and population (POPU)

foryears 1964 to 1999 for Switzerland.

SWXLP:SWXLP

is a daily data set of the Swiss pension fund benchmark LPP-2000. The

data set ranges from 2000-01-03 to 2007-05-08 (1917 observations). The

first column contains the dates. The remaining columns are named: SBI,

SPI, SII, LP25, LP40, LP60.

usdthb:usdthb

Tick data of US Dollar (USD) in Thailand Bhat (THB) collected from

Reuters. The date is in the first column in YYYYMMDDhhmm format. The

remaining columns contain: delay time (DELAY), contributor

(CONTRIBUTOR), bid (BID) and ask (ASK) prices,

and quality flag (FLAG). It covers the Asia FX crisis in June

1997.

References

Capitalization:

World Federation of Stock Exchanges,

http://www.world-exchanges.org/statistics.

cars2:

Derived from the car90 dataset within the rpart package.

The car90 dataset is based on the car.all dataset in S-PLUS.

Original data comes from:

April 1990, Consumer Reports Magazine,

pages 235-255, 281-285 and 287-288.

DowJones30

https://www.yahoo.com.

HedgeFund:

http://www.hennesseegroup.com/indices/returns/year/2005.html.

msft.dat:

https://www.yahoo.com.

nyse:

https://www.nyse.com.

PensionFund:

SBI, SPI, SII: SIX (Swiss Exchange Zurich);

LPP25, LPP40, LPP60: Banque Pictet Geneva;

LMI, MPI, ALT: Recalculated from the indices and benchmarks.

swissEconomy:

https://www.oecd.org/ and https://www.imf.org/.

SWXLP:

SBI, SPI, SII: SIX (Swiss Exchange Zurich);

LPP25, LPP40, LPP60: Banque Pictet Geneva.

usdthb:

Reuters Select Feed Terminal (1997).

Examples

## Plot DowJones30 Example Data Set

series <- timeSeries::as.timeSeries(DowJones30)

head(series)

#> GMT

#> AA AXP T BA CAT C KO DD EK XOM GE GM

#> 1990-12-31 5.92 4.70 14.67 21.77 9.30 1.87 9.88 13.15 23.02 12.09 4.63 19.72

#> 1991-01-02 5.92 4.70 14.67 21.77 9.30 1.87 9.88 13.15 23.02 12.09 4.63 19.72

#> 1991-01-03 5.88 4.73 14.73 21.71 9.15 1.87 9.60 12.83 22.95 12.15 4.53 19.57

#> 1991-01-04 5.76 4.73 14.79 22.50 9.00 1.92 9.85 13.06 22.74 12.27 4.47 19.00

#> 1991-01-07 5.72 4.58 14.67 21.65 8.87 1.89 9.69 12.83 22.11 12.12 4.40 18.35

#> 1991-01-08 5.63 4.53 14.73 21.34 9.05 1.85 9.60 12.60 22.18 12.09 4.44 18.28

#> HWP HD HON INTC IBM IP JPM JNJ MCD MRK MSFT MMM

#> 1990-12-31 3.91 2.80 5.70 1.20 27.86 20.45 2.67 7.31 7.08 11.83 2.08 31.41

#> 1991-01-02 3.91 2.80 5.70 1.20 27.86 20.45 2.67 7.31 7.08 11.83 2.08 31.41

#> 1991-01-03 3.91 2.74 5.67 1.20 27.95 20.21 2.67 7.23 6.99 11.45 2.09 30.90

#> 1991-01-04 3.85 2.75 5.65 1.20 27.86 20.50 2.69 7.18 7.02 11.27 2.11 30.80

#> 1991-01-07 3.88 2.65 5.50 1.19 27.39 20.45 2.58 6.96 6.80 10.97 2.08 30.43

#> 1991-01-08 3.90 2.59 5.47 1.18 27.08 20.26 2.58 7.02 6.83 11.01 2.04 29.65

#> MO PG SBC UTX WMT DIS

#> 1990-12-31 10.55 20.91 9.75 9.31 7.05 7.86

#> 1991-01-02 10.55 20.91 9.75 9.31 7.05 7.86

#> 1991-01-03 10.27 20.70 9.64 9.19 7.05 7.82

#> 1991-01-04 10.24 20.48 9.56 9.24 6.97 7.79

#> 1991-01-07 10.08 20.05 9.40 8.95 6.82 7.58

#> 1991-01-08 10.11 20.02 9.32 8.78 6.85 7.41

plot(series[,1:6], type = "l")

## msft.dat contains (almost?) the same data as MSFT in package timeSeries

data(MSFT, package = "timeSeries")

m1 <- as.matrix(msft.dat[, -1]) # drop date stamps in column 1

m2 <- as.matrix(MSFT)

all.equal(m1, m2, check.attributes = FALSE) # TRUE

#> [1] TRUE

## compare the dates:

all.equal(format(msft.dat[ , 1]), format(time(MSFT))) # TRUE

#> [1] TRUE

## msft.dat contains (almost?) the same data as MSFT in package timeSeries

data(MSFT, package = "timeSeries")

m1 <- as.matrix(msft.dat[, -1]) # drop date stamps in column 1

m2 <- as.matrix(MSFT)

all.equal(m1, m2, check.attributes = FALSE) # TRUE

#> [1] TRUE

## compare the dates:

all.equal(format(msft.dat[ , 1]), format(time(MSFT))) # TRUE

#> [1] TRUE