Autocorrelation function plots

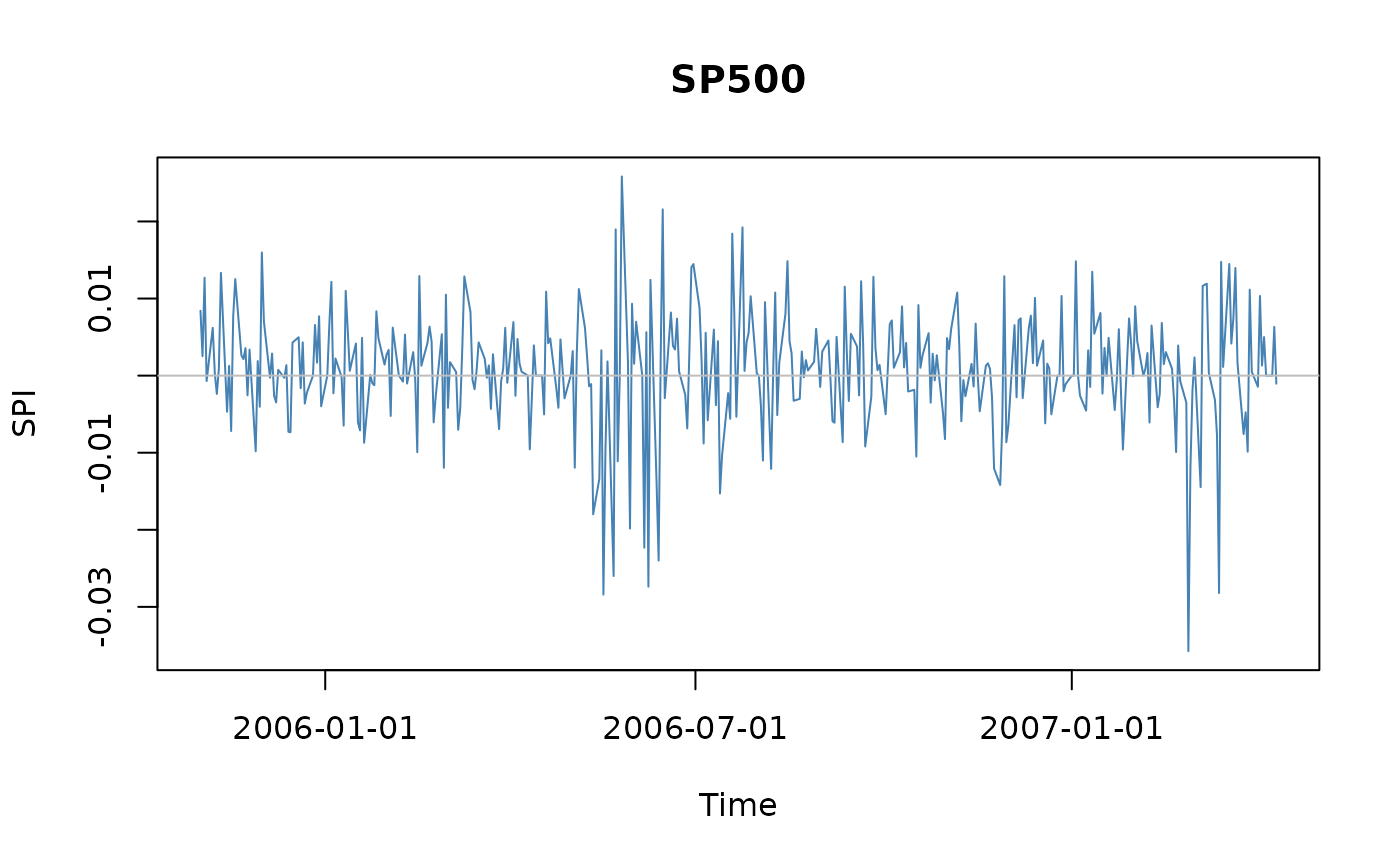

plot-acfPlot.RdProduce plots of the autocorrelation function (ACF), the partial ACF, the lagged ACF, and the Taylor effect plot.

Arguments

- x

-

an uni- or multivariate time series of class

"timeSeries"or any other object which can be transformed by the functionas.timeSeries()into an object of class"timeSeries". - labels

-

a logical value, whether or not x- and y-axes should be automatically labeled and a default main title should be added to the plot. By default

TRUE. - n

an integer value, the number of lags.

- lag.max

-

maximum lag for which the autocorrelation should be calculated, an integer.

- type

-

a character string which specifies the type of the input series, either

"returns"or"values". In the case of a return series as input, the required value series is computed by cumulating the financial returns:exp(colCumsums(x)) - deltas

-

the exponents, a numeric vector, by default ranging from 0.2 to 3.0 in steps of 0.2.

- ymax

-

maximum y-axis value on plot. If

NA, then the value is selected automatically. - standardize

-

a logical value. Should the vector

xbe standardized? - ...

arguments to be passed.

Details

The following plots are described here:

acfPlot | autocorrelation function plot, |

pacfPlot | partial autocorrelation function plot, |

lacfPlot | lagged autocorrelation function plot, |

teffectPlot | Taylor effect plot. |

Autocorrelation Functions

The functions acfPlot and pacfPlot, plot and estimate

autocorrelation and partial autocorrelation function. The functions

allow to get a first view on correlations within the time series.

The functions are synonym function calls for R's acf and

pacf from the the ts package.

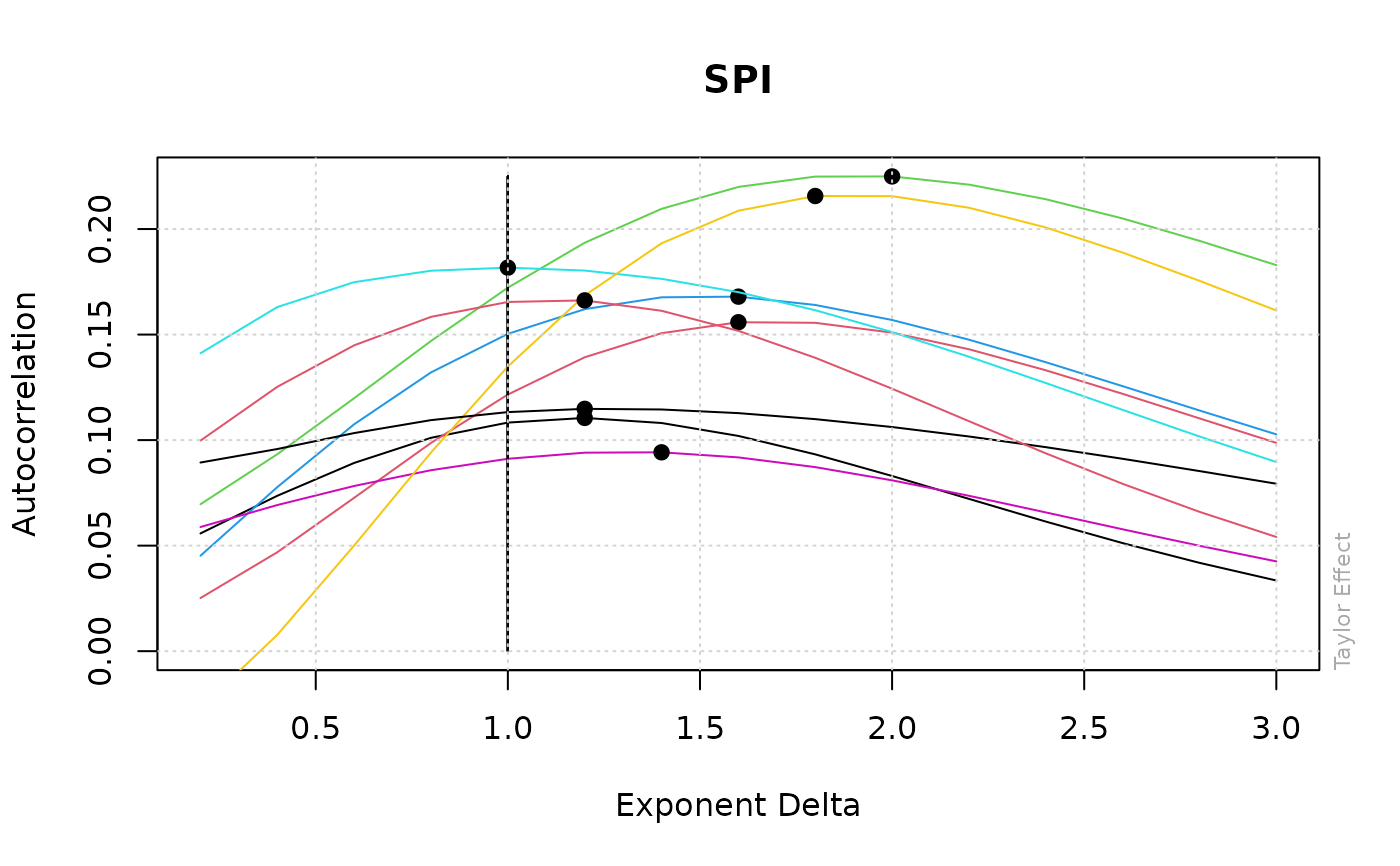

Taylor Effect

The "Taylor Effect" describes the fact that absolute returns of

speculative assets have significant serial correlation over long

lags. Even more, autocorrelations of absolute returns are typically

greater than those of squared returns. From these observations the

Taylor effect states, that that the autocorrelations of absolute

returns to the the power of delta,

abs(x-mean(x))^delta reach their maximum at delta = 1.

The function teffect explores this behaviour. A plot is

created which shows for each lag (from 1 to max.lag) the

autocorrelations as a function of the exponent delta. In the

case that the above formulated hypothesis is supported, all the

curves should peak at the same value around delta = 1.

Value

for acfPlot and pacfplot,

an object of class "acf", see acf;

for teffectPlot, a numeric matrix

of order deltas by max.lag with

the values of the autocorrelations;

for lacfPlot, a list with the following two elements:

- Rho

the autocorrelation function,

- lagged

the lagged correlations.

References

Taylor S.J. (1986); Modeling Financial Time Series, John Wiley and Sons, Chichester.

Ding Z., Granger C.W.J., Engle R.F. (1993); A long memory property of stock market returns and a new model, Journal of Empirical Finance 1, 83.