Scaling law behaviour

plot-scalinglawPlot.RdEvaluates the scaling exponent of a financial return series and plots the scaling law.

Arguments

- x

an uni- or multivariate return series of class

"timeSeries"or any other object which can be transformed by the functionas.timeSeries()into an object of class"timeSeries".- span

-

an integer value, determines the plot range. The defaault computes a reasonable number of points for the scaling range, assuming daily data with 252 business days per year.

- doplot

a logical value. Should a plot be displayed?

- labels

a logical value. Whether or not x- and y-axes should be automatically labeled and a default main title should be added to the plot. By default

TRUE.- trace

a logical value. Should the computation be traced?

- ...

arguments to be passed to

plot.

Value

a list with the following components:

- Intercept

intercept,

- Exponent

the scaling exponent,

- InverseExponent

the inverse of the scaling component.

Details

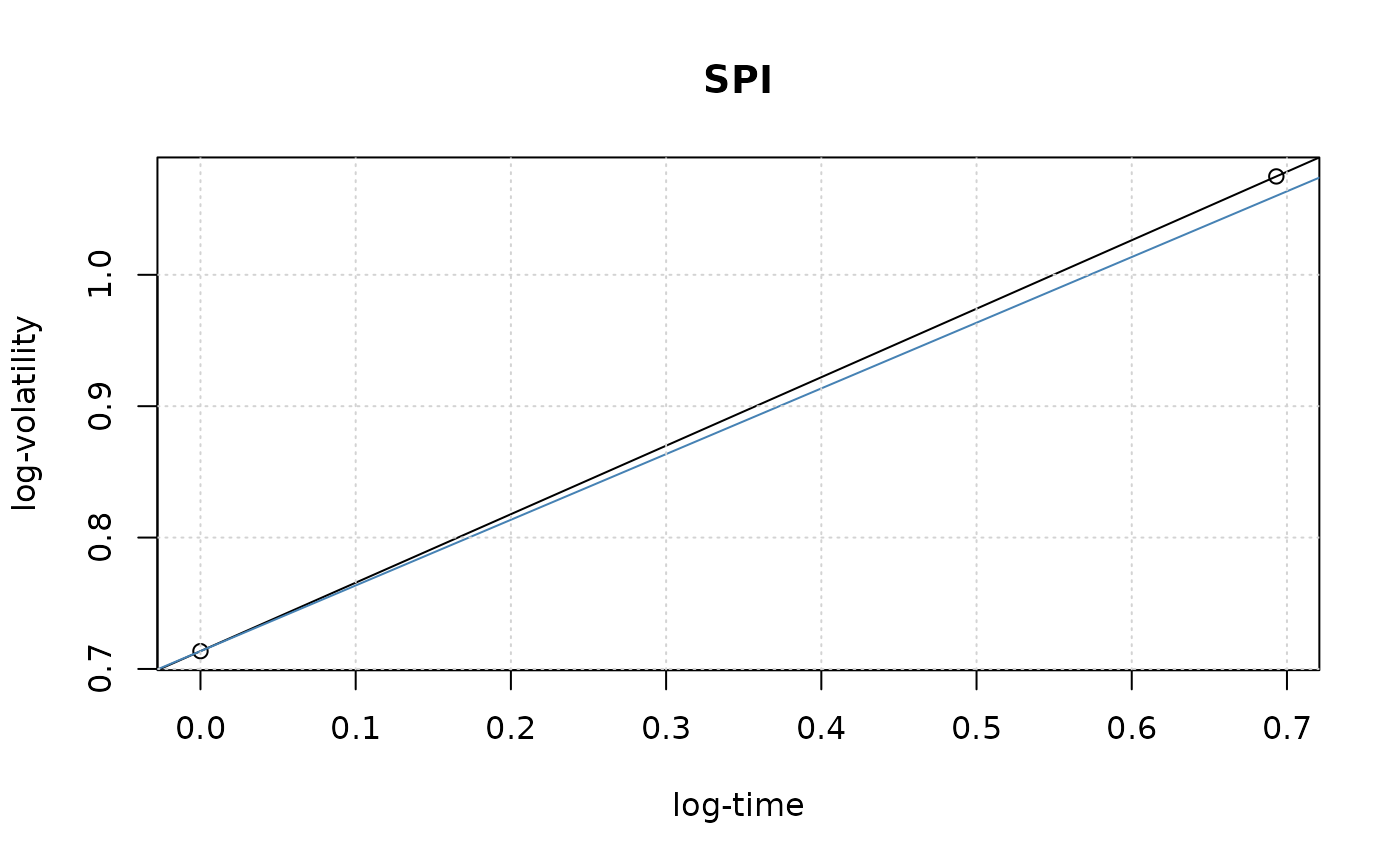

The function scalinglawPlot plots the scaling law of financial

time series under aggregation and returns an estimate for the scaling

exponent. The scaling behavior is a very striking effect of the

foreign exchange market and also other markets expressing a regular

structure for the volatility. Considering the average absolute return

over individual data periods one finds a scaling power law which

relates the mean volatility over given time intervals to the size of

these intervals. The power law is in many cases valid over several

orders of magnitude in time. Its exponent usually deviates

significantly from a Gaussian random walk model which implies 1/2.

Examples

## data

data(LPP2005REC, package = "timeSeries")

SPI <- LPP2005REC[, "SPI"]

plot(SPI, type = "l", col = "steelblue", main = "SP500")

abline(h = 0, col = "grey")

## Scaling Law Effect

scalinglawPlot(SPI)

## Scaling Law Effect

scalinglawPlot(SPI)

#>

#> Scaling Law: SPI

#> Plot Intercept 0.7135344

#> Plot Slope 0.5213102

#> Plot Inverse Slope 1.918244

#>

#>

#> Scaling Law: SPI

#> Plot Intercept 0.7135344

#> Plot Slope 0.5213102

#> Plot Inverse Slope 1.918244

#>