Compute Value-at-Risk (VaR) and expected shortfall (ES)

VaR.RdCompute Value-at-Risk (VaR) and Expected Shortfall (ES) for a fitted GARCH-APARCH model.

Usage

# S3 method for class 'fGARCH'

VaR(dist, p_loss = 0.05, ..., tol)

# S3 method for class 'fGARCH'

ES(dist, p_loss = 0.05, ...)Arguments

- dist

an object from class

"fGARCH", obtained fromgarchFit().- p_loss

level, default is 0.05.

- ...

not used.

- tol

tollerance

Note

We use the traditional definition of VaR as the negated lower

quantile. For example, if \(X\) are returns on an asset,

VAR\({}_\alpha\) = \(-q_\alpha\), where

\(q_\alpha\) is the lower \(\alpha\) quantile of \(X\).

Equivalently, VAR\({}_\alpha\) is equal to the lower

\(1-\alpha\) quantile of \(-X\) (the loss series). For

details see the vignette in package cvar availalble at

https://cran.r-project.org/package=cvar/vignettes/Guide_cvar.pdf

(or by calling vignette("Guide_cvar", package = "cvar")).

If you wish to overlay the VaR or ES over returns, just negate the VaR/ES, see the examples.

Examples

## simulate a time series of returns

x <- garchSim( garchSpec(), n = 500)

class(x)

#> [1] "timeSeries"

#> attr(,"package")

#> [1] "timeSeries"

## fit a GARCH model

fit <- garchFit(~ garch(1, 1), data = x, trace = FALSE)

head(VaR(fit))

#> 2024-09-16 2024-09-17 2024-09-18 2024-09-19 2024-09-20 2024-09-21

#> 0.005205758 0.005190033 0.005114265 0.005391635 0.005264419 0.005132978

head(ES(fit))

#> 2024-09-16 2024-09-17 2024-09-18 2024-09-19 2024-09-20 2024-09-21

#> 0.006534349 0.006514630 0.006419614 0.006767447 0.006607913 0.006443081

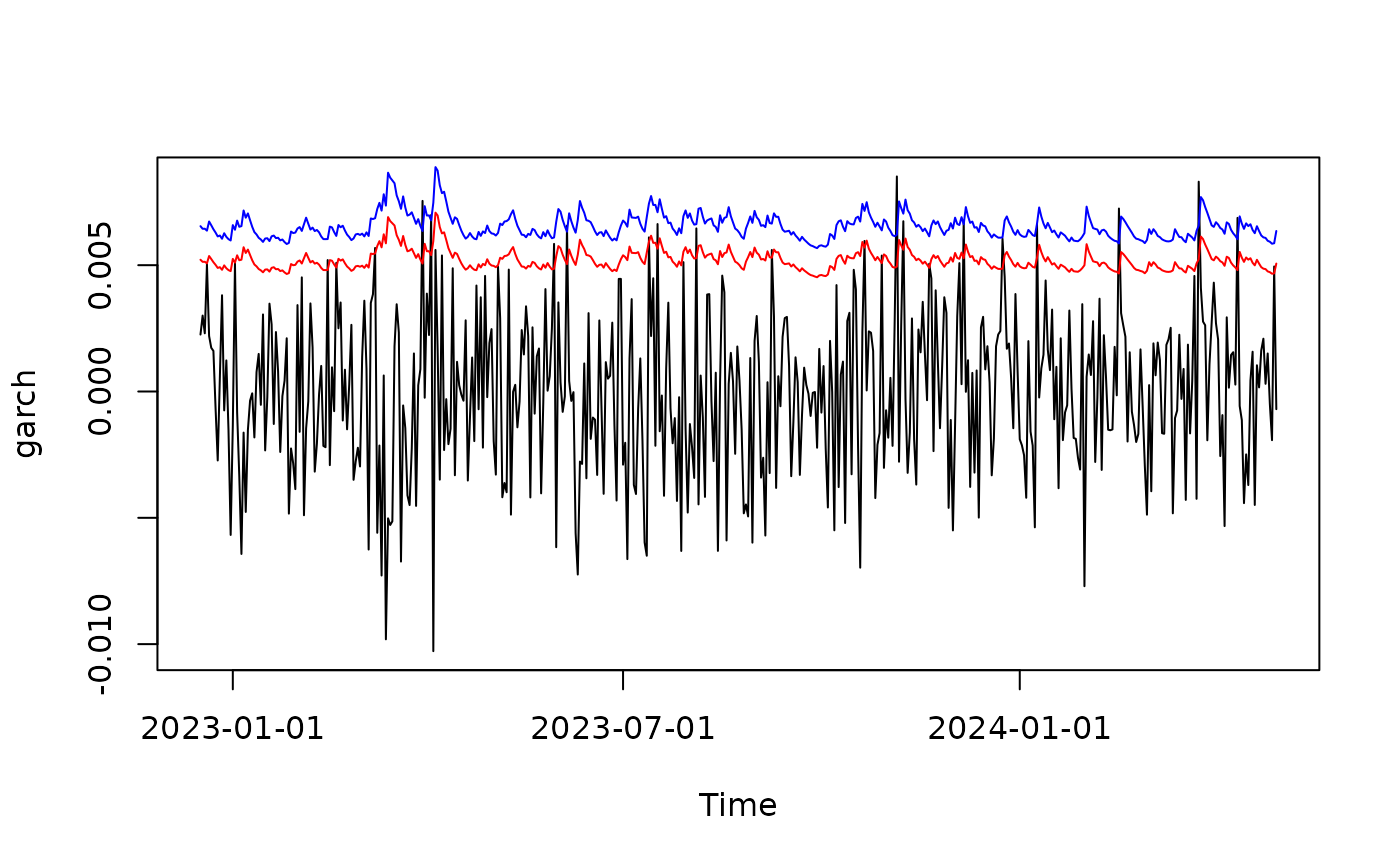

## use plot method for fitted GARCH models

plot(fit, which = 14) # VaR

plot(fit, which = 15) # ES

plot(fit, which = 15) # ES

plot(fit, which = 16) # VaR & ES

plot(fit, which = 16) # VaR & ES

## plot(fit) # choose the plot interactively

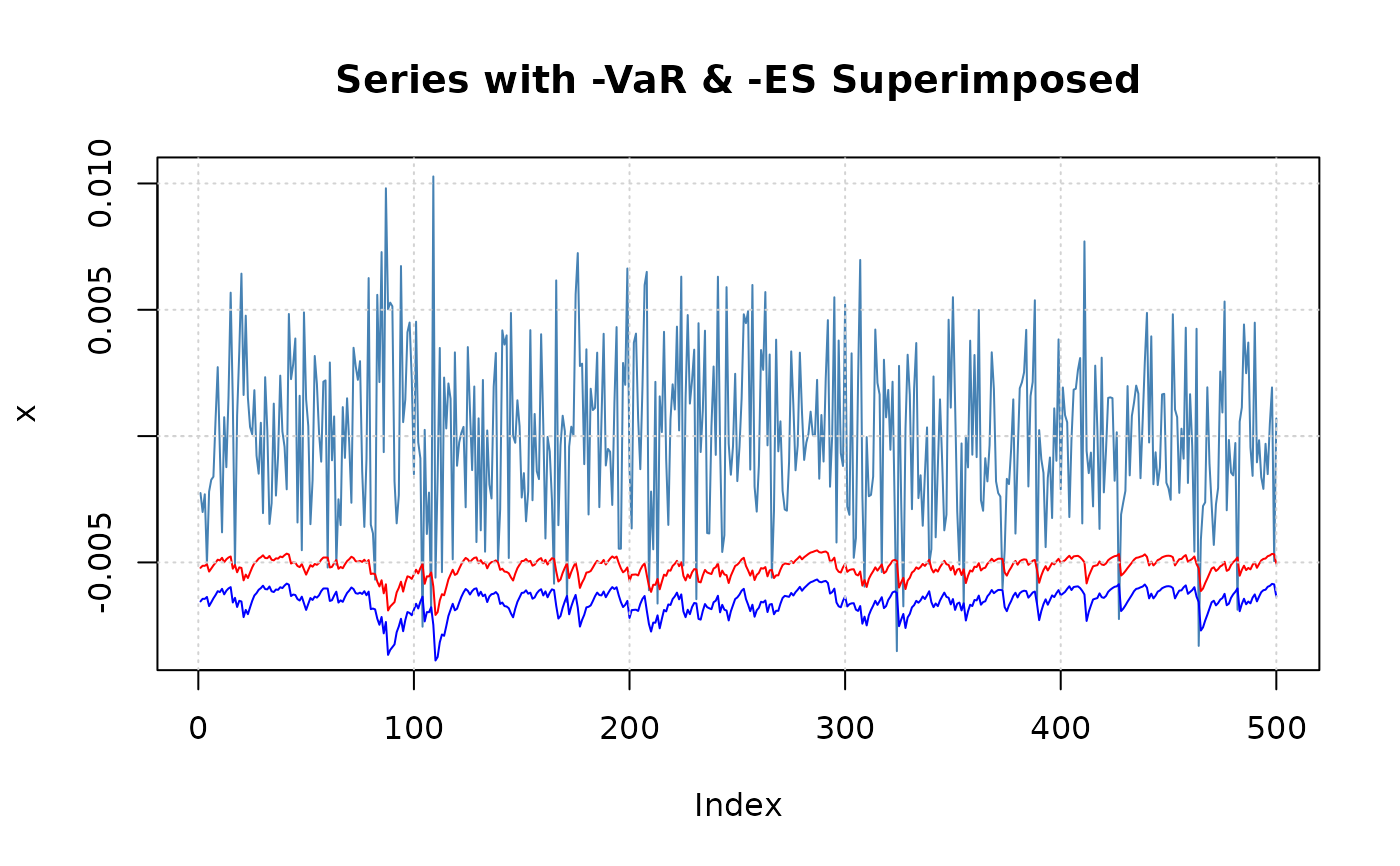

## diy plots

## overlay VaR and ES over returns

## here x is from class 'timeSeries', so we convert VaR/ES to timeSeries

## don't forget to negate the result of VaR()/ES(),

plot(x)

lines(timeSeries(-VaR(fit)), col = "red")

lines(timeSeries(-ES(fit)), col = "blue")

## plot(fit) # choose the plot interactively

## diy plots

## overlay VaR and ES over returns

## here x is from class 'timeSeries', so we convert VaR/ES to timeSeries

## don't forget to negate the result of VaR()/ES(),

plot(x)

lines(timeSeries(-VaR(fit)), col = "red")

lines(timeSeries(-ES(fit)), col = "blue")

## alternatively, plot losses (rather than returns) and don't negate VaR()/ES()

plot(-x)

lines(timeSeries(VaR(fit)), col = "red")

lines(timeSeries(ES(fit)), col = "blue")

## alternatively, plot losses (rather than returns) and don't negate VaR()/ES()

plot(-x)

lines(timeSeries(VaR(fit)), col = "red")

lines(timeSeries(ES(fit)), col = "blue")