Simulate from MixAR models

mixAR_sim.RdSimulate from MixAR models

Usage

mixAR_sim(model, n, init, nskip = 100, flag = FALSE)

mixAny_sim(model, n, init, nskip=100, flag = FALSE,

theta, galpha0, galpha, gbeta)Arguments

- model

model from which to simulate, an object inheriting from class

MixAR.- init

initial values, numeric vector.

- n

size of the simulated series.

- nskip

number of burn-in values, see Details.

- flag

if

TRUEreturn also the regimes.- theta

ma coef, a list.

- galpha0

alpha0[k], k=1,...,g.

- galpha

garch alpha.

- gbeta

garch beta.

Details

mixAR_sim simulates a series of length nskip+n and

returns the last n values.

mixAny_sim simulates from a MixAR model with GARCH

innovations. mixAny_sim was a quick fix for Shahadat and needs

consolidation.

The vector init provides the initial values for

\(t=...,-1,0\). Its length must be at least equal to the maximal AR

order. If it is longer, only the last max(model@order) elements

are used.

Examples

exampleModels$WL_ibm

#> An object of class "MixARGaussian"

#> Number of components: 3

#> prob shift scale order ar_1 ar_2

#> Comp_1 0.5439 0 4.8227 2 0.6792 0.3208

#> Comp_2 0.4176 0 6.0082 2 1.6711 -0.6711

#> Comp_3 0.0385 0 18.1716 1 1.0000

#>

#> Distributions of the error components:

#> standard Gaussian

#>

## simulate a continuation of BJ ibm data

ts1 <- mixAR_sim(exampleModels$WL_ibm, n = 30, init = c(346, 352, 357), nskip = 0)

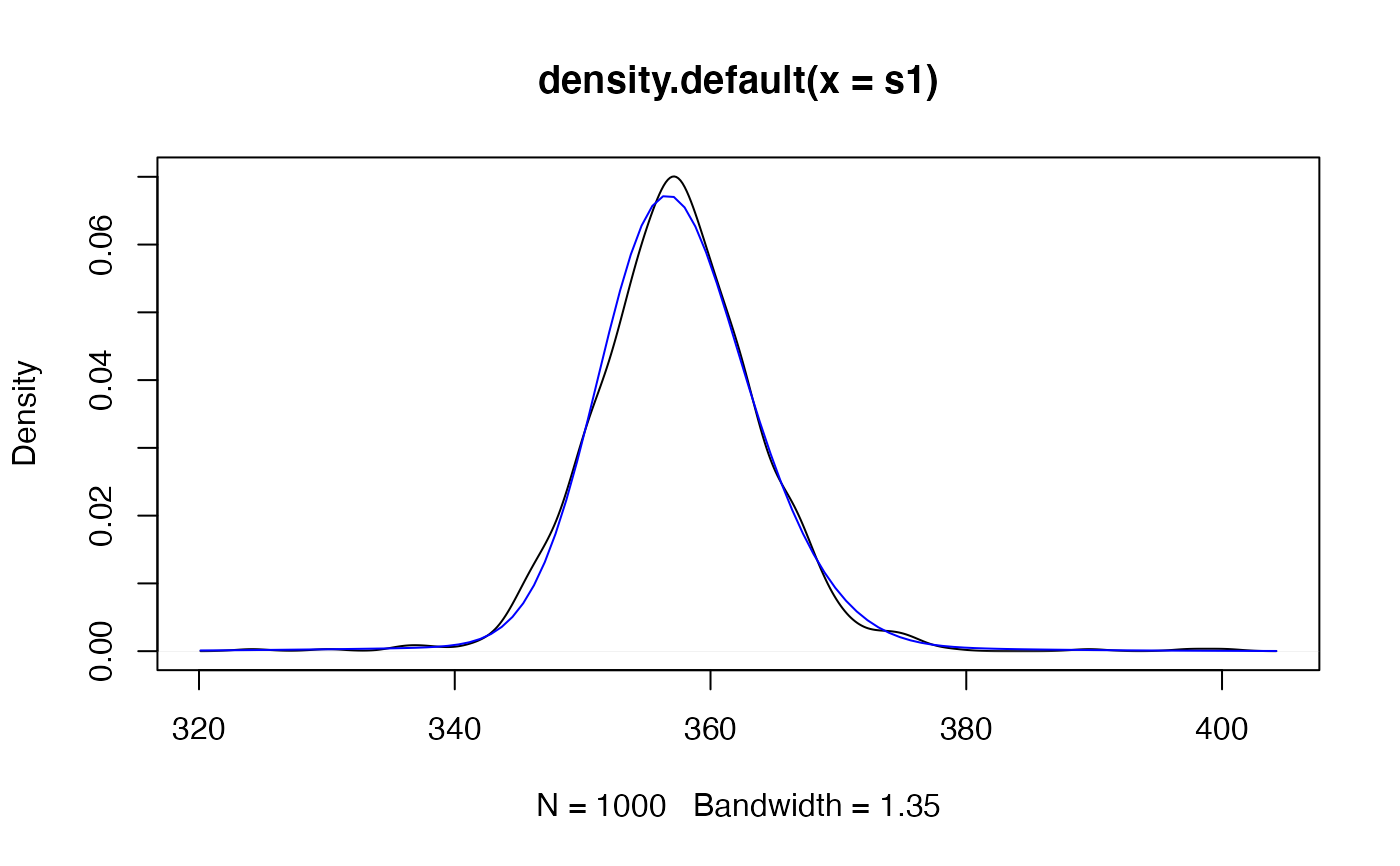

# a simulation based estimate of the 1-step predictive distribution

# for the first date after the data.

s1 <- replicate(1000, mixAR_sim(exampleModels$WL_ibm, n = 1, init = c(346, 352, 357),

nskip = 0))

plot(density(s1))

# load ibm data from BJ

## data(ibmclose, package = "fma")

# overlay the 'true' predictive density.

pdf1 <- mix_pdf(exampleModels$WL_ibm, xcond = as.numeric(fma::ibmclose))

curve(pdf1, add = TRUE, col = 'blue')

# estimate of 5% quantile of predictive distribution

quantile(s1, 0.05)

#> 5%

#> 347.3328

# Monte Carlo estimate of "expected shortfall"

# (but the data has not been converted into returns...)

mean(s1[ s1 <= quantile(s1, 0.05) ])

#> [1] 342.6269

# estimate of 5% quantile of predictive distribution

quantile(s1, 0.05)

#> 5%

#> 347.3328

# Monte Carlo estimate of "expected shortfall"

# (but the data has not been converted into returns...)

mean(s1[ s1 <= quantile(s1, 0.05) ])

#> [1] 342.6269