Turning points of a time series

fin-turnpoints.RdExtracts and analyzes turning points of an univariate

"timeSeries" object.

Details

The function turns determines the number and the positions of

extrema (turning points, either peaks or pits) in a regular time

series.

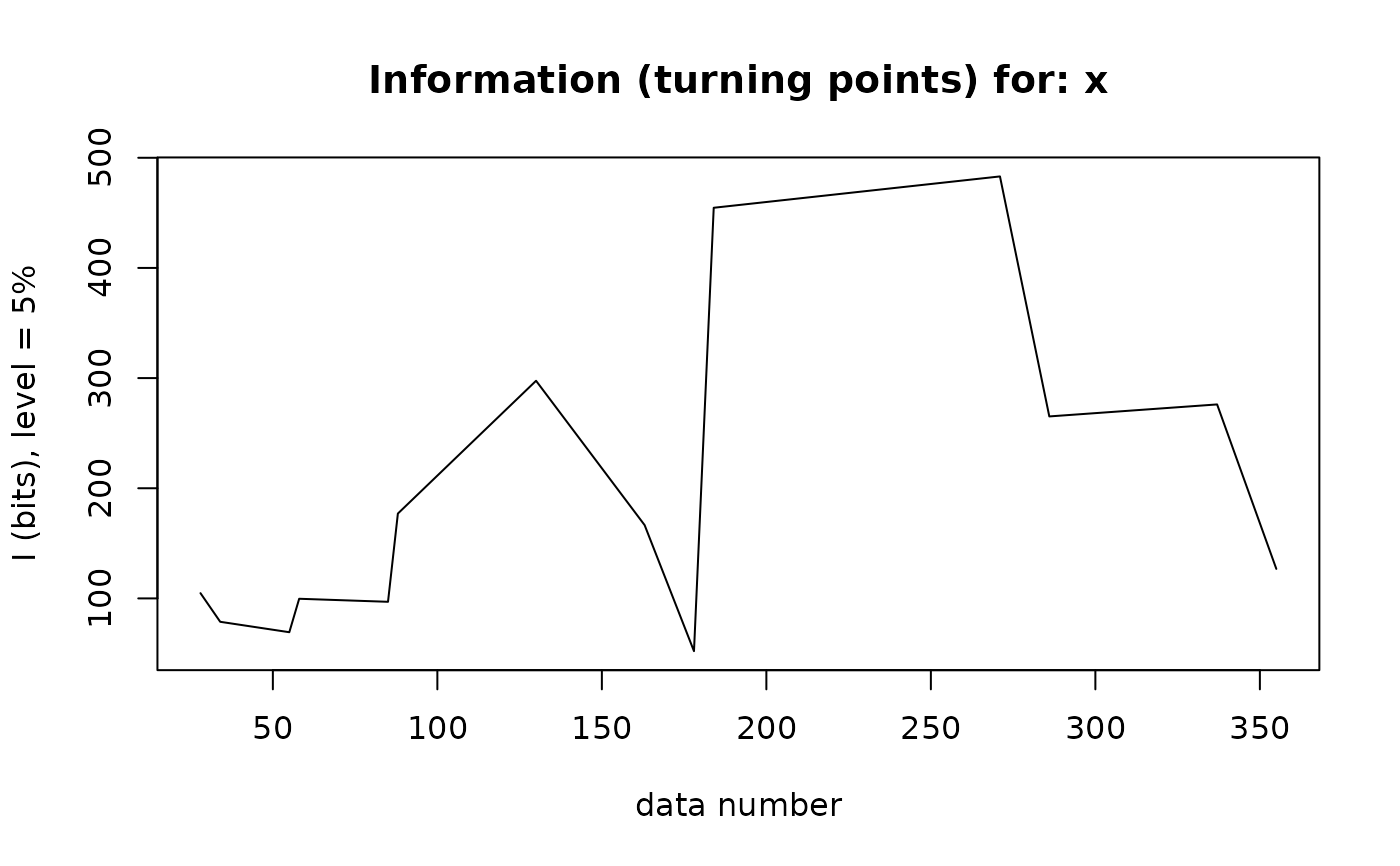

The function turnsStats calculates the quantity of information

associated with the observations in this series, according to

Kendall's information theory.

The functions are borrowed from the contributed R package

pastecs and made ready for working together with univariate

timeSeries objects. You need not to load the R package

pastecs, the code parts we need here are builtin in the

timeSeries package.

We have renamed the function turnpoints to turns to

distinguish between the original function in the contributed R package

pastecs and our Rmetrics function wrapper.

For further details please consult the help page from the contributed

R package pastecs.

Value

for turns, an object of class timeSeries.

for turnsStats, an object of class turnpoints with the

following entries:

- data

The dataset to which the calculation is done.

- n

The number of observations.

- points

The value of the points in the series, after elimination of ex-aequos.

- pos

The position of the points on the time scale in the series (including ex-aequos).

- exaequos

Location of exaequos (1), or not (0).

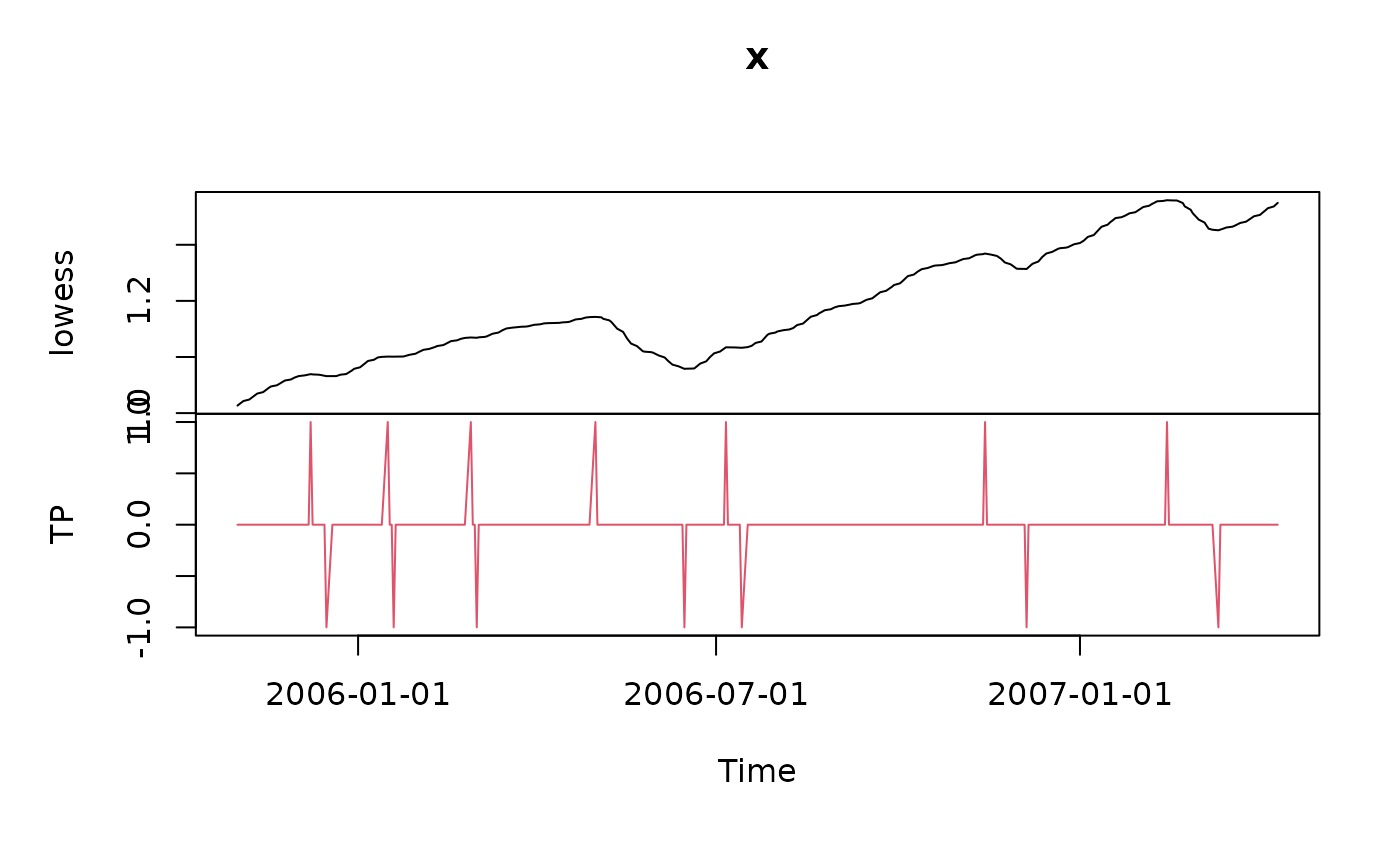

- nturns

Total number of turning points in the whole time series.

- firstispeak

Is the first turning point a peak (TRUE), or not (FALSE).

- peaks

Logical vector. Location of the peaks in the time series without ex-aequos.

- pits

Logical vector. Location of the pits in the time series without ex-aequos.

- tppos

Position of the turning points in the initial series (with ex-aequos).

- proba

Probability to find a turning point at this location.

- info

Quantity of information associated with this point.

Author

Frederic Ibanez and Philippe Grosjean for code from the contributed R

package pastecs and Rmetrics for the function wrapper.

References

Ibanez, F., 1982, Sur une nouvelle application de la theorie de l'information a la description des series chronologiques planctoniques. J. Exp. Mar. Biol. Ecol., 4, 619–632

Kendall, M.G., 1976, Time Series, 2nd ed. Charles Griffin and Co, London.

Examples

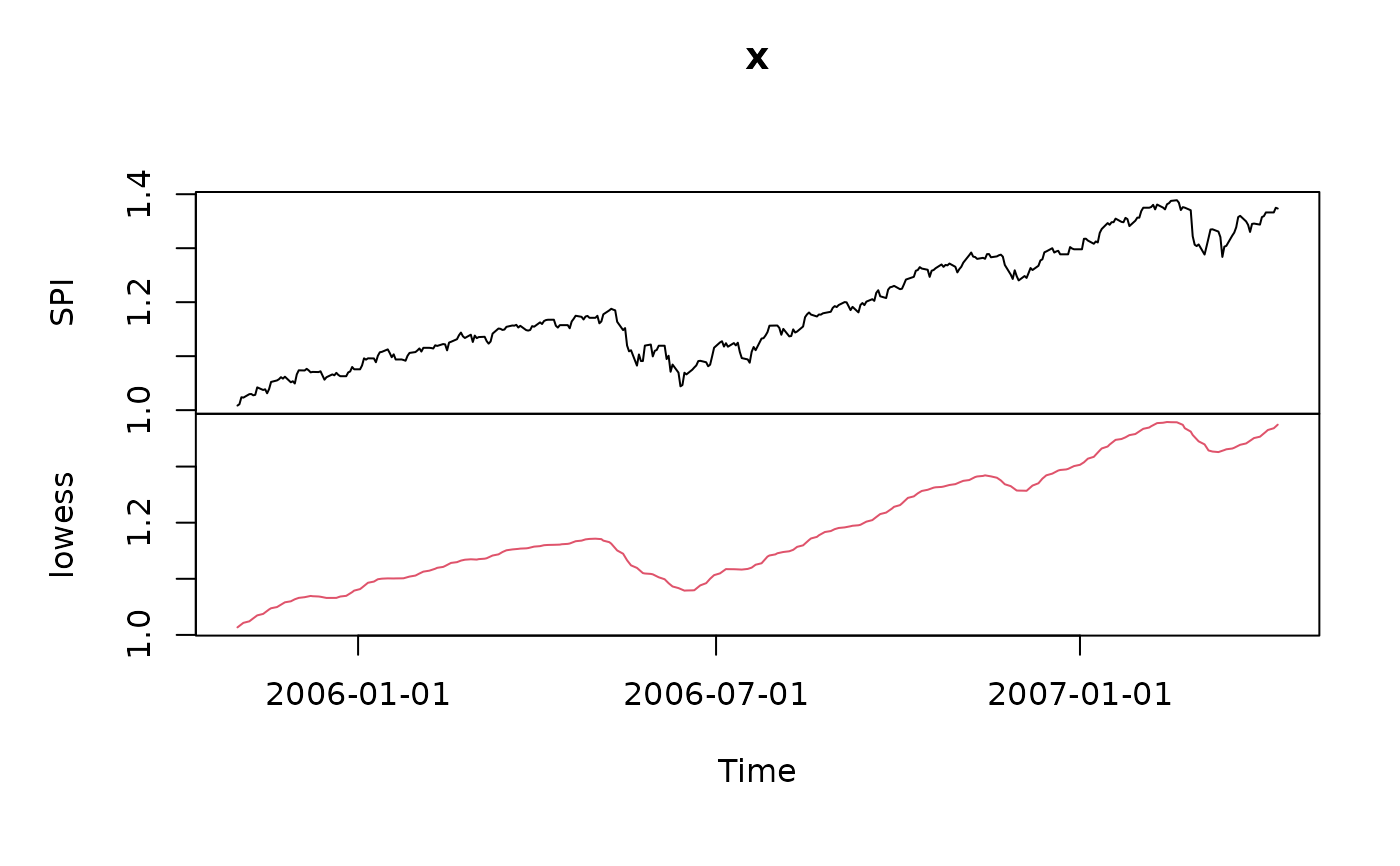

## Load Swiss Equities Series -

SPI.RET <- LPP2005REC[, "SPI"]

head(SPI.RET)

#> GMT

#> SPI

#> 2005-11-01 0.008414595

#> 2005-11-02 0.002519342

#> 2005-11-03 0.012707292

#> 2005-11-04 -0.000702757

#> 2005-11-07 0.006205226

#> 2005-11-08 0.000329260

## Cumulate and Smooth the Series -

SPI <- smoothLowess(cumulated(SPI.RET), f=0.05)

plot(SPI)

## Plot Turn Points Series -

SPI.SMOOTH <- SPI[, 2]

tP <- turns(SPI.SMOOTH)

plot(tP)

## Plot Turn Points Series -

SPI.SMOOTH <- SPI[, 2]

tP <- turns(SPI.SMOOTH)

plot(tP)

## Compute Statistics -

turnsStats(SPI.SMOOTH)

#> Turning points for: x

#>

#> nbr observations : 377

#> nbr ex-aequos : 0

#> nbr turning points: 14 (first point is a peak)

#> E(p) = 250 Var(p) = 66.7 (theoretical)

#>

#> point type proba info

#> 1 28 peak 2.894020e-32 104.76862

#> 2 34 pit 1.941760e-24 78.76891

#> 3 55 peak 1.370106e-21 69.30620

#> 4 58 pit 9.874935e-31 99.67600

#> 5 85 peak 6.665581e-30 96.92111

#> 6 88 pit 5.157541e-54 177.01743

#> 7 130 peak 2.664544e-90 297.55964

#> 8 163 pit 7.413829e-51 166.52811

#> 9 178 peak 2.069038e-16 52.10189

#> 10 184 pit 1.402003e-137 454.61666

#> 11 271 peak 3.830644e-146 483.06391

#> 12 286 pit 1.471670e-80 265.19679

#> 13 337 peak 7.722581e-84 276.09288

#> 14 355 pit 6.778577e-39 126.79421

## Compute Statistics -

turnsStats(SPI.SMOOTH)

#> Turning points for: x

#>

#> nbr observations : 377

#> nbr ex-aequos : 0

#> nbr turning points: 14 (first point is a peak)

#> E(p) = 250 Var(p) = 66.7 (theoretical)

#>

#> point type proba info

#> 1 28 peak 2.894020e-32 104.76862

#> 2 34 pit 1.941760e-24 78.76891

#> 3 55 peak 1.370106e-21 69.30620

#> 4 58 pit 9.874935e-31 99.67600

#> 5 85 peak 6.665581e-30 96.92111

#> 6 88 pit 5.157541e-54 177.01743

#> 7 130 peak 2.664544e-90 297.55964

#> 8 163 pit 7.413829e-51 166.52811

#> 9 178 peak 2.069038e-16 52.10189

#> 10 184 pit 1.402003e-137 454.61666

#> 11 271 peak 3.830644e-146 483.06391

#> 12 286 pit 1.471670e-80 265.19679

#> 13 337 peak 7.722581e-84 276.09288

#> 14 355 pit 6.778577e-39 126.79421